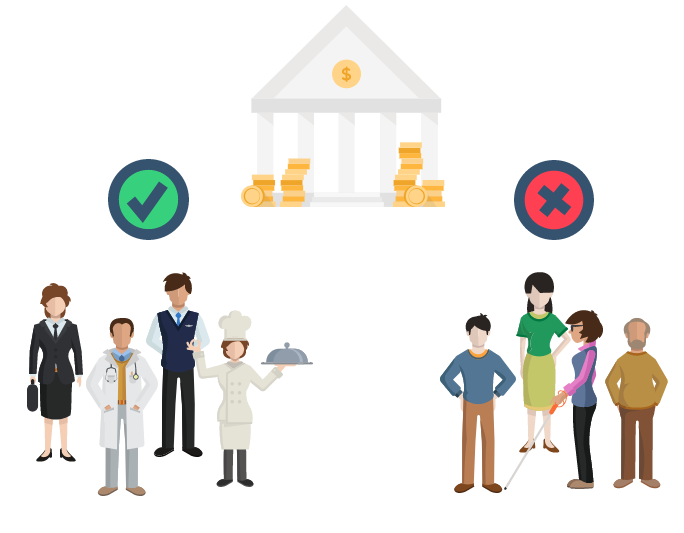

Today, most finance institutions choose to serve only “prime” borrowers, and almost always stops short of offering anything but the safest (to the lender) “secure” facilities. By secure, we could use also phrases such as “collateral-backed”, “guaranteed by borrower or third parties” and “income verified” to describe the levels of security that traditional lenders require of customers.

We recognize and understand the financial hardships low income earners face and wish to make a real difference to their lives. The inability of these people to apply for bank loans, credit cards or store credit to help fund small consumer durables (items considered a necessity today such as entry level smart phones, kitchen equipment and furniture), result in many left with no other choice but to turn to money lenders. Ironically, despite the plethora of existing micro-finance institutions catering to this segment, they do so only to provide assistance with either income generating loans or large ticket items (such as tractors or auto-rickshaws).

Most financial institutions today focus only on serving “prime” borrowers, those with verifiable incomes or sufficient collateral to back them. However, there are many people in society without the means to provide such securities. Unfortunately, these individuals are often...